Learn how Grove Bank helps homeowners and buyers get the most out of their homes

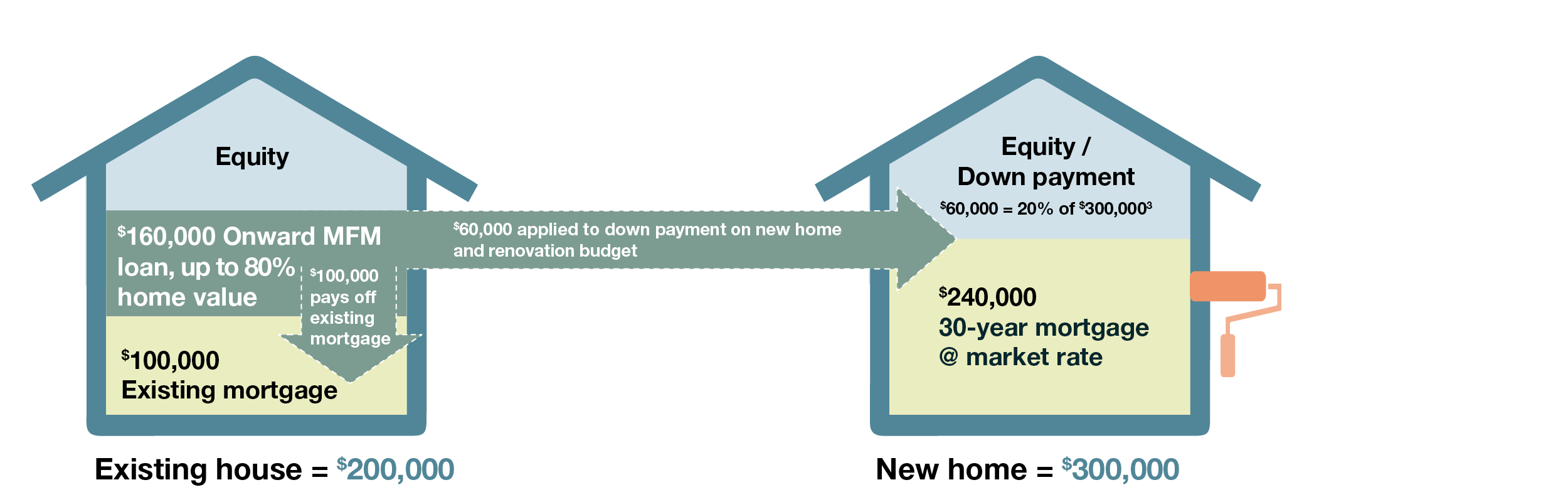

By using your home's existing equity, Grove Bank makes investing in your home simple and reduces the stress of a renovation and home sale at the same time. Whether you are buying a new home that needs updates to match your family's lifestyle or want to ensure you get top dollar for your current home before you sell, Grove has you covered. Grove Bank structures a loan package that will ensure you only have one mortgage and releases the equity in your current home to make improvements.

Find the home that is right for your family

This communication is provided to you for informational purposes only and should not be relied upon by you. The owner of this site is not a mortgage lender and you should contact Grove Bank directly to learn more about its mortgage products and your eligibility for such products.